Military Life Insurance Spouse - Thank you for being there, my God! I'm so glad you found me! If you like Joe, oh my god! Don't miss a post by subscribing to my newsletter! However, this post may contain affiliate links and this blog is for entertainment purposes only.

Welcome back! Good that you are here! If you like Joe, oh my god! Don't miss a post by subscribing to my newsletter! However, this post may contain affiliate links and this blog is for entertainment purposes only.

Military Life Insurance Spouse

This is a sponsored post by me on behalf of USAA Life Insurance Company and USAA Life Insurance Company of New York. All opinions are 100% mine.

Military Spouse Of The Year

Talking about life insurance is not how most people want to spend a Friday evening. Or any evening or any part of the day, really. And this applies to both civilians and military personnel.

Talking about life insurance makes us face not only our mortality, but also our loved ones. it is sad. And when we don't talk about life insurance, we don't learn about it or think about it or even ask what to do with it.

Because life insurance is not something to be afraid of. This is not an afterthought. It is not forbidden. And definitely not something to look forward to. It's a tool to ensure your family's financial well-being, no matter what happens in the future.

You don't build a house without infrastructure. Do not build your family finances on a basis that is not compatible with a life insurance policy.

How Does Sgli Work In The Event Of Divorce?

Big news for military families? Thanks to Uncle Sam and organizations that meet the specific and unique needs of military families when it comes to life insurance, additional tools are available for your family's financial foundations.

Let's get to the brass pieces and jump. What every military spouse should know about life insurance:

Many military spouses are under the impression that group life insurance covers their service members as well. Spoiler alert: It's not. SGLI is for military members only. (If you're a military spouse and also a service member, it's a completely different story because you have a separate SGLI policy from your spouse to cover you.) There is a program called FSGLI for families (which we will). in about a minute).

And many military spouses also believe that only people with salaried jobs should (or can) get life insurance. This is not true on both counts. Whether you're unemployed (by choice or circumstance) or underemployed, you still need to protect your family through life insurance... and there are policies that are affordable!

Military Spouse Of The Year Lauded For Devotion To Gold Star Families > U.s. Department Of Defense > Defense Department News

And let's get this out of the way, even if you don't traditionally work and are currently helping your family as a stay-at-home parent/wife, your housework expenses are a part of your life. Insurance may cover it. (But more on that later.)

If you are not in the military yourself, you cannot get life insurance through the military. You can get this through private insurance. And that's where USAA comes in.

Chances are, you probably have an auto or home insurance policy with USAA. If you don't, you surely know someone who does. They also have a life insurance policy for you.

One of the things I love most about USAA is that they understand military families and military life, not only because they need military people, but because many of their employees are veterans. Spouses are military, or otherwise tied to military experience. They offer an array of life insurance options that provide peace of mind and financial stability for military-connected families.

Armed Forces Insurance Base Spouses Of The Year

Let's start by talking about the two types of military life insurance that most soldiers and their families know and understand: SGLI and VGLI.

SGLI stands for Service Members Group Life Insurance. Eligibility for SGLI includes members of the active military (including the Coast Guard), commissioned members of the National Oceanic and Atmospheric Administration or USPHS, students studying at a nation's military academies, or reserve officers including members of the ROTC. Cadets, or intermediates in authorized training or exercises, members of the Ready Reserve or National Guard (with certain conditions), or volunteers of the Ready Reserve (with certain conditions). Service members who are eligible are automatically enrolled. SGLI coverage can increase up to $400,000 on $50,000. You can learn more about SGLI benefits through the VA website.

VGLI stands for Veterans Group Life Insurance and is only available under certain circumstances through the Department of Veterans Affairs. You can check these requirements on the VA website to see if your veteran qualifies. VGLI term benefits are limited to $10,000 and up to a maximum of $400,000 (again, depending on individual circumstances).

Military life insurance is one piece of the financial puzzle, but it's not everything. Let's talk a little about private life insurance options, which can help fill in the gaps that SGLI or VGLI might not.

Guardian Spouse Named Military Spouse Of The Year > Space Operations Command (spoc) > Article Display

Term life insurance is not a permanent insurance policy. It is available for a certain period at a higher level of insurance than other options. Term life insurance is used tactically, for a specific purpose—like when you might be covering student loans or a mortgage. This is not a solution for the rest of your life. When the policy expires, renewals may be more expensive and/or have less coverage.

Permanent life insurance policies provide lifetime coverage and have death benefits. A whole life insurance policy is a type of permanent life insurance policy. Private insurers may have different permanent life insurance options. For example, USAA offers Simple Whole Life, Universal Life, and Whole Life Warranty. As an added benefit to a permanent life insurance policy, a portion of your premium is interest income that you can access throughout your lifetime.

Just as every military tour is different, every life insurance plan is different depending on your family and needs. Determining your family's needs, including your major risks, is a process. It may take a while to gather the information you need to make the best decision... but it's worth it when you think about the benefits of having the right size policy and the peace of mind you'll have.

While you want to speak with the best people at USAA when choosing your life insurance coverage, you can take the first steps in determining which products are right for you by clicking on the tab:

Military Level Term

If you are not currently earning, think about the cost of your work in the family. Sure, you may not be getting paid right now, but what you're doing is worth it. If you can't do that, why should your husband outsource the running of the house? Just consider the costs of daycare and kindergarten. The service you provide to your family is invaluable. Be sure to include this in your numbers.

Life insurance can sometimes seem like an important decision. And waiting to make this decision can cost you in several ways. Most life insurance premiums increase as you age, making it possible for you to finance your life insurance as young as possible. Even if you don't have to worry about these particular expenses, the cost of doing nothing can be devastating to your family. This is something you do not want to pass on to your children or spouse.

But the good news? Getting started is easy. Visit USAA Life online for a personalized assessment of your family's needs. If you would like to speak with someone else, call 800-531-LIFE to speak with a USAA Life Insurance Specialist who can answer your questions.

Be the first to get your free ticket to The Pillar Deployed Retreat, the only virtual deployment retreat for military spouses and significant others. Thanks to USAA Life Insurance Company and USAA Life Insurance Company of New York, we can offer you three full days of expert sessions, giveaways and support!

Military Spouse Transition & Readiness Seminar

I knew I was getting hired before I started dating John. We had known each other for more than a decade at that time

My phone rang two years ago in a snowy, cold, late January. John and I had only been married for six months and

Disclosure: I received a product from OrangeGlade for review. I only review and endorse products that I enjoy and believe my readers will enjoy as well. Here you can verify the functionality of your browser.

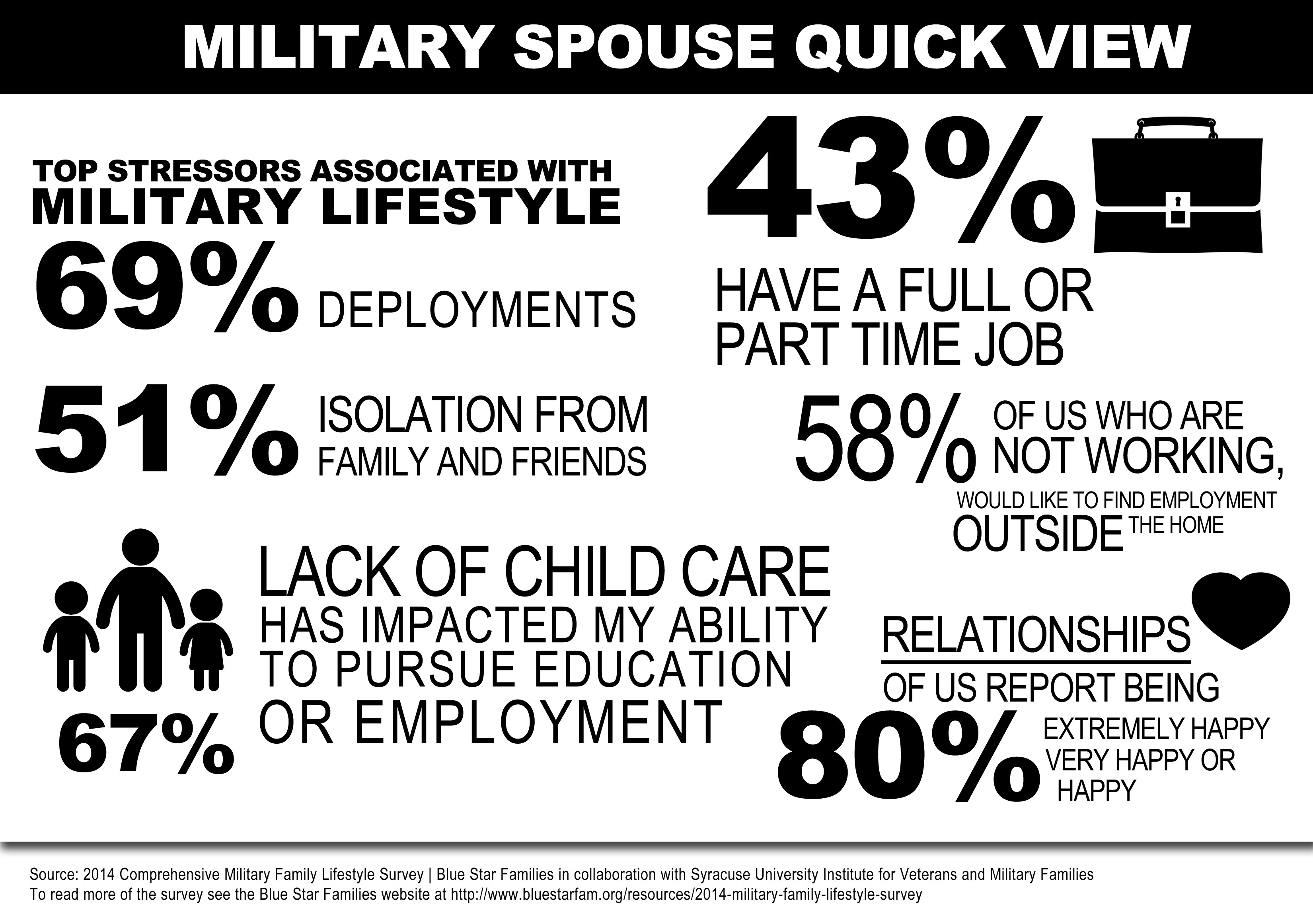

Military spouses often face employment challenges due to their spouse's occupation, and the global pandemic has made it even worse. The unemployment rate for military spouses is nearly three times higher than the national average. According to the Navy's federal survey, 13 percent of military spouses are unemployed and 43 percent of military spouses are underemployed. Both unemployed and underemployed, military spouses have identified unique challenges related to deployment, childcare responsibilities, and the economic impact of the COVID-19 pandemic.

Mba 10 Year & 20 Year Level Term Life Insurance

As a military spouse myself, I know that military spouses face a unique task

Military spouse scholarships, military spouse education grants, military spouse life insurance, military spouse program, military spouse education opportunities, military spouse tuition assistance, military spouse schooling, military spouse education program, military spouse education assistance, military spouse career training, military spouse education, military spouse grants

0 Comments